The relentless hum of mining rigs, a constant digital heartbeat in the quest for cryptocurrency rewards, has evolved from a niche pursuit to a multi-billion dollar industry. But the days of casually firing up your desktop computer and passively earning Bitcoin are long gone. Today, maximizing mining efficiency demands a sophisticated, data-driven approach, leveraging analytics and real-time insights to optimize every facet of the operation. This evolution necessitates a shift from gut feeling to rigorous analysis, transforming mining from a gamble into a calculated endeavor.

At the heart of this data-driven revolution lies the mining rig itself. Gone are the days of monolithic, one-size-fits-all solutions. Modern miners are increasingly bespoke, tailored to specific algorithms and optimized for energy efficiency. Analyzing hashrate performance, power consumption, and operating temperature in real-time provides crucial data points for tweaking individual rigs and identifying potential bottlenecks. This granular level of control allows for dynamic adjustments, ensuring each rig operates at its peak potential, maximizing its contribution to the overall mining pool.

However, optimizing individual rigs is just one piece of the puzzle. The real power of data-driven mining emerges when these individual data streams are aggregated and analyzed holistically. Understanding the collective performance of an entire mining farm, identifying trends, and proactively addressing potential issues becomes paramount. Are certain rigs consistently underperforming? Is a particular cooling system proving inadequate? These are the questions that data analytics can answer, enabling operators to make informed decisions and preempt costly downtime.

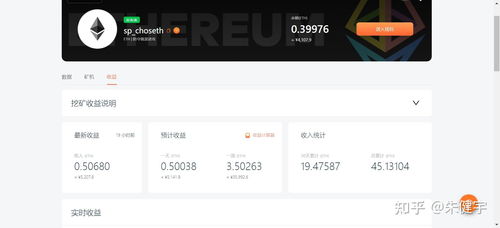

Furthermore, data plays a crucial role in optimizing mining pool participation. While solo mining remains a theoretical possibility, the vast majority of miners participate in pools, pooling their computational power to increase their chances of securing block rewards. Analyzing pool statistics, payout structures, and historical performance data allows miners to strategically allocate their resources, joining pools that offer the highest potential returns while minimizing risks. This strategic approach to pool selection can significantly impact overall profitability.

Beyond the technical aspects of mining, data-driven insights are also transforming the financial side of the equation. The volatility of cryptocurrencies like Bitcoin, Ethereum, and Dogecoin makes profitability forecasting a complex undertaking. However, by analyzing historical price data, market trends, and even social sentiment, miners can develop more accurate models for predicting future profitability. This allows for better capital allocation, more informed investment decisions, and a more resilient mining operation.

The landscape of cryptocurrency exchanges also factors heavily into the profitability equation. Miners typically convert their earned cryptocurrency into fiat currency or other cryptocurrencies. Understanding the fees, liquidity, and security protocols of various exchanges is critical. Data-driven analysis of exchange performance can help miners choose the most cost-effective and secure platforms for managing their digital assets, maximizing their returns and minimizing their exposure to risk.

The increasing sophistication of mining operations has also led to the rise of specialized mining machine hosting services. These services provide infrastructure, cooling, and security for mining rigs, allowing individuals and businesses to participate in cryptocurrency mining without the burden of managing their own facilities. Data plays a crucial role in evaluating the performance and reliability of these hosting services, ensuring that miners are getting the best possible value for their investment. Factors such as uptime, network connectivity, and security measures can all be quantified and analyzed to make informed decisions about hosting providers.

The future of cryptocurrency mining is undoubtedly data-driven. As the industry continues to mature and competition intensifies, the ability to leverage data analytics will become increasingly crucial for survival and success. From optimizing individual rigs to strategically allocating resources within mining pools, data provides the insights needed to navigate the complexities of the cryptocurrency landscape and maximize profitability. The relentless pursuit of efficiency will continue to drive innovation, pushing the boundaries of what is possible in the world of cryptocurrency mining, ultimately shaping the future of decentralized finance.

In conclusion, embracing data-driven approaches is no longer a luxury but a necessity for anyone seeking to thrive in the competitive world of cryptocurrency mining. By harnessing the power of analytics and real-time insights, miners can unlock new levels of efficiency, resilience, and profitability, ensuring they remain at the forefront of this rapidly evolving industry. The future belongs to those who can extract the most value from the vast sea of data that surrounds them, transforming raw information into actionable insights and ultimately, a more profitable mining operation.

One response to “Data-Driven Approaches to Enhancing Mining Efficiency in Cryptocurrency”

This article explores innovative algorithms and real-time analytics to optimize cryptocurrency mining, blending machine learning, energy management, and economic forecasting. It offers unexpected insights into sustainability challenges and adaptive strategies, making it a must-read for tech enthusiasts and industry professionals alike.